What is dTRINITY?

dTRINITY (short for "DeFi Trinity") is the world's first subsidized stablecoin protocol, a new DeFi primitive designed to stimulate onchain credit markets by providing sustainable interest rebates to stablecoin borrowers.

Unlike traditional models that only reward passive holders, stakers, or lenders on the supply side, dTRINITY flips the script by using its stablecoin float revenue to actively subsidize borrowers on the demand side.

Why dTRINITY?

dTRINITY transforms passive float revenue from its stablecoin’s collateral reserves into an active mechanism that accelerates credit expansion, money velocity, and ecosystem growth. Borrower subsidies also unlock a higher economic equilibrium that produces better yields for lenders and LPs, benefiting both sides of the market.

Like Yin and Yang, dTRINITY introduces the long-missing counterpart to traditional supply-centric models in DeFi—completing the feedback loop between stablecoins, liquidity, and credit ☯️

For more details, please refer to Problems & Solution.

Who does dTRINITY benefit?

- Stablecoin borrowers benefit from lower net interest rates and improved capital efficiency.

- Yield loopers benefit from subsidized leverage, allowing them to capture greater carry.

- Stablecoin lenders benefit from structurally higher utilization and yields, driven by subsidized credit demand.

- Stablecoin LPs benefit from increased trading volume and fee generation, boosted by money velocity.

For user instructions and current opportunities, please refer to User Guide.

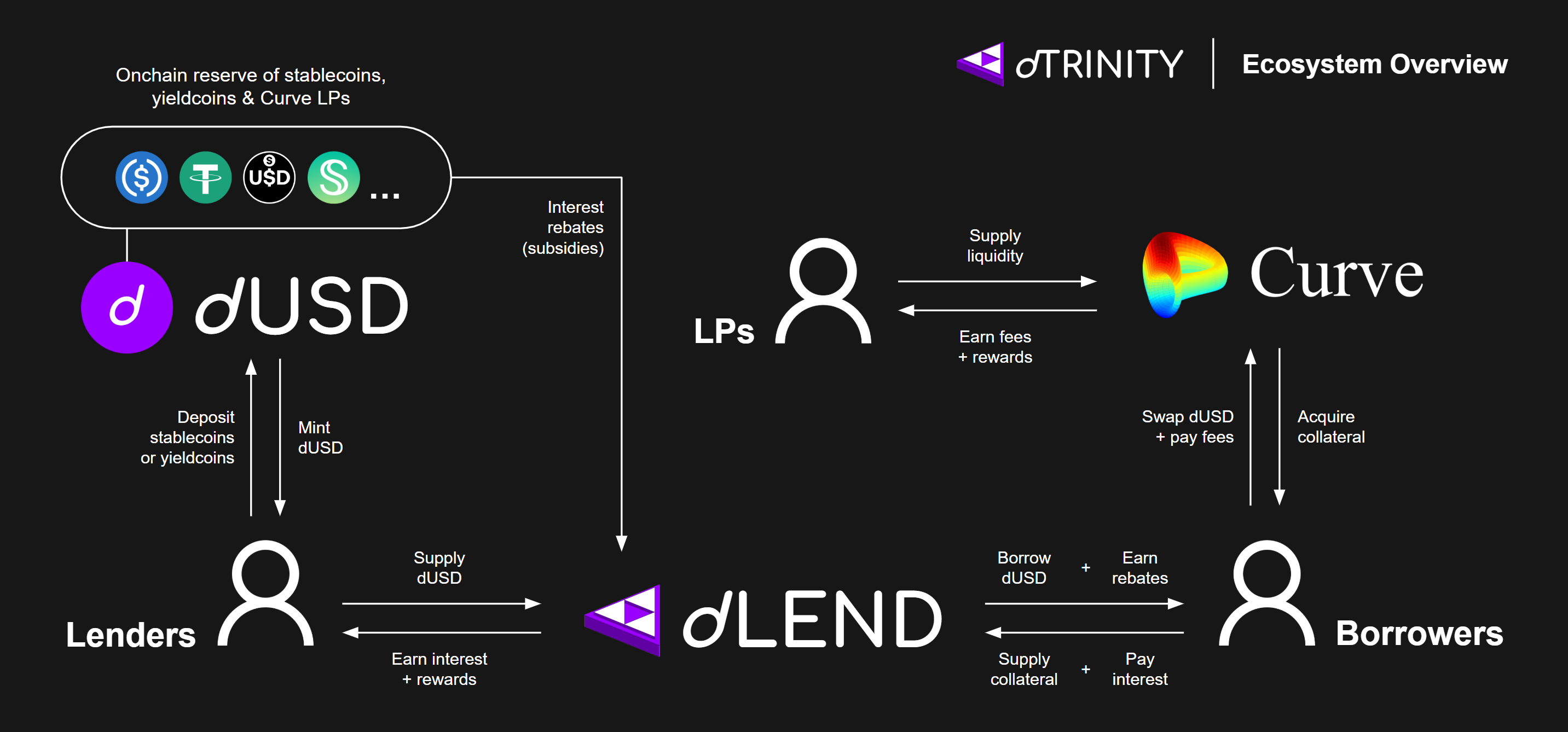

How does dTRINITY work?

Core Components

dTRINITY consists of 3 core DeFi primitives:

dUSD, a decentralized stablecoin backed by exogenous, yield-bearing reserves.

dLEND, an Aave V3 fork that offers dUSD loans with interest rebates.

Curve liquidity pools for dUSD and other protocol-issued tokens.

Other Components

Additional protocol components include:

sdUSD, a liquid lending vault and yieldcoin equivalent of dUSD.

dT Points, a points program to reward early liquidity contributors.

LST 🚧, the first subsidized liquid-staking tokens for ETH and BTC.

dLOOP 🚧, subsidized yield looping vaults powered by dLEND and dUSD.

TRIN 🚧, the future protocol governance token based on veTokenomics.

For more details, please refer to  Protocol Components.

Protocol Components.

Protocol Components.

Protocol Components.DeFi Flywheel

1. Lenders and LPs mint dUSD, introducing new reserves, credit supply, and liquidity into the ecosystem.

2. Float revenue from the reserve funds borrower subsidies, reducing net costs.

3. Borrowers supply collateral to borrow dUSD, paying gross interest while earning rebates.

4. Credit demand and utilization start rising toward a higher equilibrium.

5. Eventually, borrowers pay above-market gross interest rates, but net borrowing costs after rebates remain near market levels.

6. Lenders now earn above-market yields, driven by subsidized credit demand.

7. Borrowers sell dUSD on DEXs to access liquidity; when borrowers unwind, they buy back dUSD to repay debt.

8. LPs now earn higher trading fees thanks to increased trading volume and money velocity.

9. Improved yields and fee earnings attract more capital into the ecosystem.

10. Repeat ☯️

For more details, please refer to Stablecoinomics 101.

Where is dTRINITY deployed?

dTRINITY is live on Ethereum, Fraxtal, and Katana. Additional chain expansions are planned for Ethereum L2 networks, including Base. External markets for protocol-issued tokens are also available through strategic ecosystem integrations like Curve, Sushi Swap, and Morpho.

For more details, please refer to  Network Support and DeFi Partners.

Network Support and DeFi Partners.

Network Support and DeFi Partners.

Network Support and DeFi Partners.When is the TGE?

The TGE (token generation event) for TRIN is set to take place during the second half of 2026. Prior to the TGE, early liquidity contributors are rewarded via the points program. At the TGE, all points earned will become claimable for TRIN tokens. More details will be released prior to the TGE.