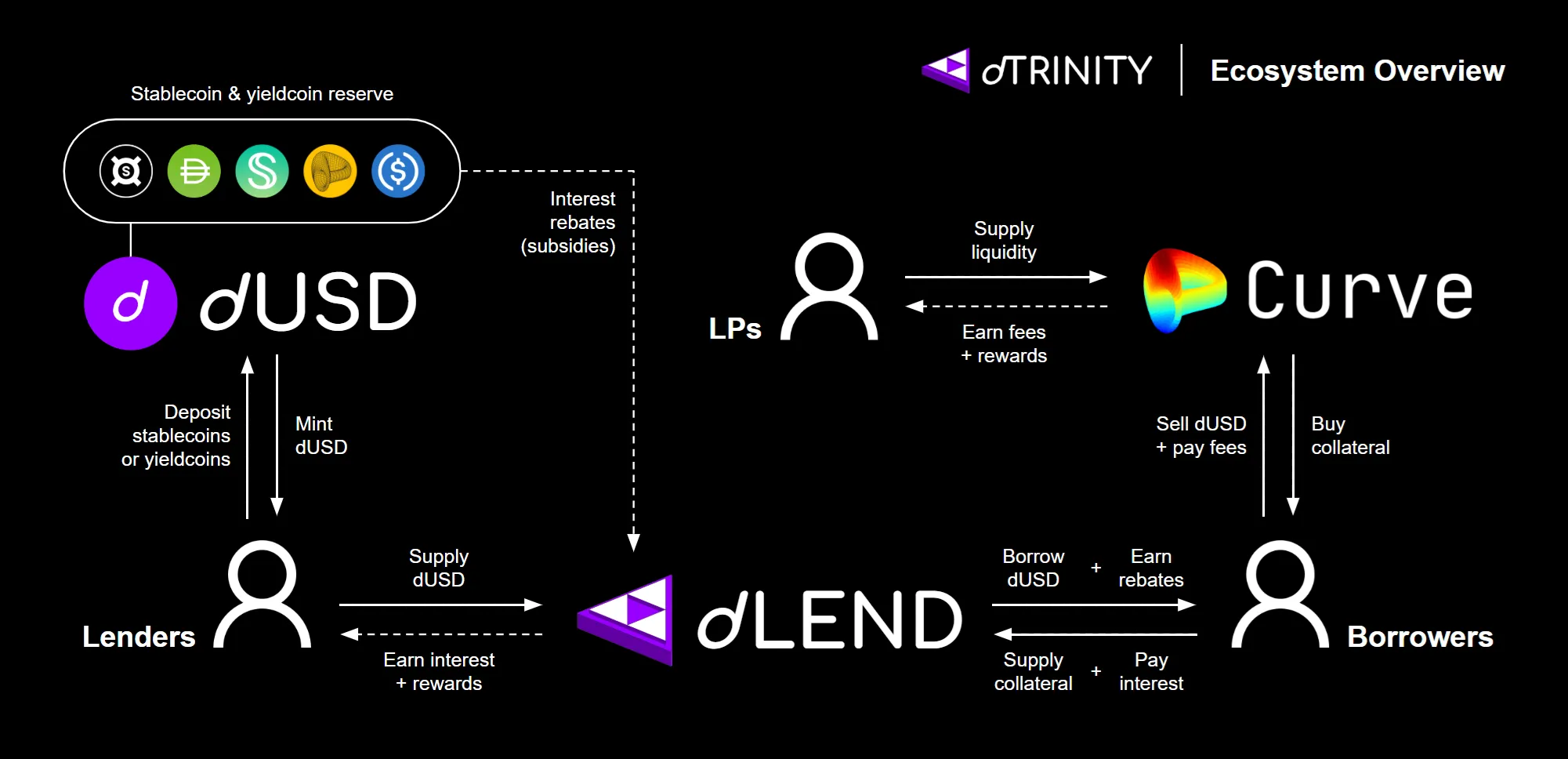

Introducing the world’s first subsidized stablecoin protocol, designed to reduce borrowing costs and enhance yields for stablecoin users.

dTRINITY first debuted on Fraxtal in December 2024. The protocol has been live on Sonic since May 2025, with follow-on expansions to Ethereum and other chains in Q3-Q4.

As the name implies, dTRINITY consists of three key DeFi primitives:

- A suite of decentralized stablecoins fully backed by exogenous, yield-bearing reserves

- A decentralized lending protocol that offers subsidized stablecoin loans

- External DEX liquidity pools for protocol-issued stablecoins

Additionally, tradable vaults for lending, looping, and liquidity provision strategies will be released to further simplify user experience, optimize yields, and enable composability for advanced integrations with other DeFi protocols.

By year-end, a utility token will be launched to empower the dTRINITY community with governance rights over the protocol. Until then, users who supply liquidity to the protocol will earn loyalty points via the  Points Program, which can be converted to utility tokens at the TGE.

Points Program, which can be converted to utility tokens at the TGE.

Points Program, which can be converted to utility tokens at the TGE.

Points Program, which can be converted to utility tokens at the TGE.

Core Components

Decentralized Stablecoins

dUSD is a USD-pegged stablecoin, fully backed by other USD-denominated stablecoins and yieldcoins. Similarly,

dUSD is a USD-pegged stablecoin, fully backed by other USD-denominated stablecoins and yieldcoins. Similarly,  dS is a stablecoin pegged to Sonic (S), fully backed by S and S-based LSTs. In the near future, dTRINITY will extend this model by launching

dS is a stablecoin pegged to Sonic (S), fully backed by S and S-based LSTs. In the near future, dTRINITY will extend this model by launching  dETH (pegged to ETH) and

dETH (pegged to ETH) and  dBTC (pegged to BTC). These decentralized stablecoins—collectively referred to as “dSTABLE”—form one of the three core components of the dTRINITY ecosystem.

dBTC (pegged to BTC). These decentralized stablecoins—collectively referred to as “dSTABLE”—form one of the three core components of the dTRINITY ecosystem.dTRINITY's stablecoins are demand-focused, meaning they don't distribute underlying yields to token holders and stakers on the supply side. Instead, each stablecoin's reserve earnings are used to fund ongoing interest rebates for its borrowers. These rebates help subsidize dSTABLE borrowing costs, boosting credit demand, utilization, and dSTABLE lending yields.

Lending Protocol

dLEND is dTRINITY's native lending protocol powered by subsidized stablecoins. It is the second core component of the dTRINITY ecosystem.

dLEND is dTRINITY's native lending protocol powered by subsidized stablecoins. It is the second core component of the dTRINITY ecosystem.dLEND users can supply dSTABLE assets to earn yield plus rewards from the protocol and ecosystem partners. Borrowers can then supply various yield-bearing collateral to take out dSTABLE loans and earn interest rebates. As a result, dLEND users can access cheap liquidity at below-market rates, enabling more efficient leverage to amplify their yield "looping" strategies (i.e., carry trading).

Thanks to boosted credit demand and utilization—made possible by subsidized debt—dSTABLE Supply APYs will rise to above-market rates on dLEND, improving yields while reducing opportunity costs for lenders.

Decentralized Exchanges

DEX Partners like Curve enable external liquidity pools for dSTABLE assets. They are the final core component of the dTRINITY ecosystem.

DEX Partners like Curve enable external liquidity pools for dSTABLE assets. They are the final core component of the dTRINITY ecosystem. Liquidity pools are vital in facilitating low-slippage swaps and liquidations between stablecoins and other assets. LPs may also earn pool fees, points, and/or other rewards for supplying liquidity to DEXs. dSTABLE LPs, in particular, earn more pool fees thanks to boosted credit velocity and trading volume from subsidized borrowers.

In addition to Curve, other DEX integrations will be supported in the future to further bolster on-chain liquidity and unlock more yield opportunities for dSTABLE assets.

Other Components

Utility Token

TRIN is the future utility and governance token of dTRINITY. Prior to the TGE, lenders, liquidity providers, and community members are awarded dT Points via the

TRIN is the future utility and governance token of dTRINITY. Prior to the TGE, lenders, liquidity providers, and community members are awarded dT Points via the  Points Program for their ecosystem contributions. During the TGE, all accrued points will be converted to TRIN, which will officially replace dT Points as protocol-native rewards.

Points Program for their ecosystem contributions. During the TGE, all accrued points will be converted to TRIN, which will officially replace dT Points as protocol-native rewards.Staking Vaults

dSTAKE is a series of ERC-4626 vaults that allow protocol-issued stablecoins to be staked and lent automatically. These vaults are powered by dLEND, generating above-market yields thanks to subsidy-boosted utilization. They also earn points and rewards in addition to lending yields.

dSTAKE vaults unlock composability and secondary market liquidity for stakers/lenders via tradable receipt tokens, turning them into yield-bearing versions of dTRINITY’s stablecoins (i.e., yieldcoins). Users can then supply them as collateral or liquidity in other protocols to access further utilities.

Looping Vaults

Loopcoins are akin to leveraged ETFs in TradFi. They help simplify the looping process for users through a one-click experience. Loopcoins can be supplied into other protocols as well.

Liquidity Vaults

dPOOL is a series of ERC-4626 vaults that automatically provide one-sided liquidity on DEXs for assets paired with dTRINITY’s stablecoins. These vaults help simplify the LP process for users while earning them yields from pool fees and rewards. Vault depositors also receive receipt tokens called "poolcoins," which can be traded or supplied into other protocols.